With a simple application process, LoanBuilder offers quick funding and flexible repayment terms. Their online system allows small business owners to check their loan status and make payments anytime, anywhere.

Unlike many lenders, LoanBuilder does not require personal guarantees. However, they do require a UCC-1 blanket lien on all business assets.

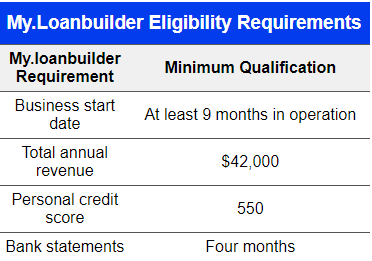

Conditions for using My.loanbuilder

LoanBuilder is a digital lender that offers small business loans. It requires a business owner to provide personal guarantees, which puts their personal assets (that are not protected by law from creditors) on the line in case of default.

The application process is quick and simple, with a minimal requirement for documentation. A hard credit check will be performed, which may impact the borrower’s credit score, but this is a necessary step to secure funding.

Borrowers are charged a fixed borrowing fee, which is a true reflection of the total interest rate on the loan. This eliminates confusion caused by differing rates from different lenders, a common problem in the marketplace.

Weekly loan payments are automatically withdrawn from the borrower’s business bank account. Customers have reported positive experiences with LoanBuilder and the customer service team.

Application procedure for new users on My Loanbuilder

If you’re in need of working capital, LoanBuilder has competitive fees and a fast application process. It’s also one of the few funding sources that can provide a flexible repayment schedule, including the ability to pay off early with no penalty. However, it’s important to note that LoanBuilder requires a UCC-1 blanket lien and personal guarantee.

To determine your eligibility, LoanBuilder evaluates your business’s financial health and reviews your credit history. If preapproved, you can then receive estimated rates and fees and customize your borrowing amount and term length.

Then, you’ll need to submit a few basic documents and electronically sign the contract. Once approved, LoanBuilder will deposit funds directly into your business bank account. Then, payments will be automatically withdrawn each week. This can be a good option for businesses that experience seasonal fluctuations.

How to apply for a loan using My Loanbuilder?

LoanBuilder is a business loan provider backed by PayPal and financed by WebBank. It offers small business loans with weekly payments, which is a good feature for businesses that see seasonal fluctuations in revenue.

The LoanBuilder lending process is relatively quick. After settling on terms, you will need to upload a few documents, including recent business bank statements. In addition, you will be asked to provide a personal guarantee.

Once you submit all required documentation, the lender will run a hard credit check that could have a slight impact on your score. Once your loan is approved, you will receive an electronic contract that you must sign. Funds are typically deposited the next business day if your application and documents are submitted before 5 pm.

What is SoloSuit?

Solosuit provides a suite of online tools to help consumers level the playing field with debt collectors. Their pricing is designed to accommodate a variety of budgets and makes it easy for anyone to assert their rights.

SoloSuit was conceived by Co-Founder George Simons to fill what he calls the “justice gap” for individuals facing debt collection lawsuits. He realized that many individuals could not afford to hire an attorney to represent them in court, and even if they did, it was difficult to find one who specialized in debt collection law.

Each year, 10 million Americans are sued for debt and 9 million lose because they can’t figure out how to respond. SoloSuit empowers individuals to easily create an automated legal response in just 15 minutes.

Respond with SoloSuit

It’s important to understand how LoanBuilder deducts repayments from your business checking account. The company withdraws payments on a weekly basis, and you can choose the day of the week it withdraws your funds. This ensures that you are not overdrawing your bank account.

If you’re served with a Summons or Complaint for debt, it is critical to respond within 21 days. This is because the plaintiff can garnish your wages or access your bank accounts if you do not respond. Fortunately, you can use SoloSuit to draft and file your Answer in minutes.

Most of the time, this will result in a settlement with the debt collector. They will agree to a stipulated payment plan that you can afford. This is especially helpful if you are experiencing financial hardship.